Inflation

On X[edit]

2010[edit]

2021[edit]

Claim: when it comes to inflation and growth, Economists don’t even understand the theory of their *own* price and quantity indices mathematically:

WILD IDEA: Maybe the economists don't actually understand what is going on right now? https://x.com/disclosetv/sta/disclosetv/status/1392488787838742536

The problem of inflation index calculation has not been adequately updated since Ragnar Frisch destroyed Irving Fisher’s attempt to axiomatize economic indices following the last great advances of F. Divisia and A. Konüs on continuous and welfare indices respectively.

Economists are holding their own field back by retaining their freedom to just cook up any revised index they want.

It’s as if physicists retained the right to define temperature differently every year based on a closed door meeting and manufactured new thermometers thereafter.

If you’re going to push us all to move to “true” “economic” indices & chain them to reflect dynamic actors (or to disguise true inflation!), you would end up chaining ordinal preferences. And you can’t do that without gauge theory because it is a problem in parallel transport.

Moral: whoever constructs CPI and GDP numbers in a dynamic economy is in a position to fake higher growth and lower inflation if they are also in a position to stop the field from debating methodological advances that would restrict the freedom to make up index number recipes. 🙏

CPI is broken. Why?

Think of CPI as a gauge like a thermometer. You can’t have politically motivated folks making your thermometers or they can change the design to cover up climate change. Likewise you can’t have economists changing the gauge to disguise the effect of printing.

A crypto native CPI governed on the blockchain to create a decentralized stablecoin people can rely on to keep their standard of living the same across time. A true alternative to fiat rather than a speculative investment asset like most other coins.

The economists can’t yet compute a dynamic Cost-Of-Living-Adjustment or COLA or “Chained Changing Preference Ordinal Welfare Konus Index” to be perfectly pedantic. Not because it doesn’t exist. But because they don’t have the math and don’t want to lose their finger on the scale.

But more importantly, we have a culture that economics literally trumpets (and I swear I am not making this up) “Economic Imperialism”. It is “we know math and you don’t”-culture.

No. They don’t know their own math. I will debate any high ranking economist on this point.

It’s time to reveal that economics, far from embracing math or having physics envy, is deliberately avoiding solutions to old problems so that it can make up new gauges for CPI/GDP at will while telling the rest of the soft sciences “We know your field better because we do math.”

No. Economics is an avoiding gauge theory, connections, Lie Groups, etc so it can retain its political relevance as an expert consultancy. I’m with the crypto folks on this. Our economy must be protected from Seigniorage (printing money) and CPI tampering (e.g. Boskin Commission).

End the forced wealth transfers of central bankers covering up their own failures with “Relief”, “Easing”, “Stimulous”, “Rescues”, “Toxic Asset Purchases”, and other bailouts of our incompetent financial overlords.

We must protect CPI from economists disguising wealth dilution.

P.S. before you remind me how arrogant this sounds, keep in mind, that I am willing to debate this publicly with any leading economist eager to defend the central bankers and triumphalist theorists openly bragging about their math. Read this, and be sick:

https://nber.org/system/files/working_papers/w7300/w7300.pdf

Moral: Gauge Theory fixes this intellectual corruption problem of economic imperialism, and #btc, blockchains and Crytpo can help.

I am wholly supportive of this effort. Whether this iteration succeeds or fails is immaterial. The important thing is to take inflation away from those who would disguise:

A) The printing of fiat money by central bankers.

B) The fact that economists are holding back the field.

Why are they holding back the theory of index numbers (CPI, GDP)? Because the more innovation, the less freedom to dial our gauges to whatever values the political patrons of macro economics ask. The field is literally held back by leading economists to preserve their own power.

Around 1996, Boskin Commissioner Jorgensen held back the biggest unambiguous advance in mathematical economics that I am aware of in decades. It would have interfered with their finding that the CPI was 1.1% overstated. He calculated 1.1% would save a round Trillion for U.S.

We can’t afford for economics to pretend it is a science in public, yet act as an incentive operated consultancy which can get you any result you need to fit the political agenda.

So this effort of @balajis needs to be supported! We must take this away from our current leaders.

Inflation is like a thermometer. You ask how hot/cold it is. You don’t get to ask “What do you need the Gauge to say? How much thumb should be on the scale?”

This is all discussed in detail by Jim Weatherall in his book in the final chapter/epilogue:

https://www.amazon.com/Physics-Wall-Street-Predicting-Unpredictable-ebook/dp/B006R8PMJS/ref=nodl_

Lastly, it is high time my co-developer of the theory got her due without being subjected to both the Matilda & Matthew effects. Man-boys really do drive technical women out of technical fields because they can’t cite a woman who is smarter than they are. Enough.

Go @balajis.

The co-developer of gauge thy in econ as a 2nd Marginal Revolution is Pia Malaney in the early 1990s at Harvard.

There is no reason to pretend this inflation thy never happened just to flatter power. Let’s disintermediate the old:

I think this is a great introduction to geometric marginalism and economic field theory. Hope you love it:

https://www.fields.utoronto.ca/talks/neoclassical-mechanics-economic-field-theory

This eliminates a step or two. You may have to watch in lower resolution if you are on your phone however: https://x.com/sabinowitz/status/1423394091409330182

You'll soon see that "The Index Number Problem" lies beneath everything from the measurement of the impact of prices on households/consumers, to the construction of Divisa Monetary Aggregates & the measurement of the money supply.

Our gauges are riddled with error & discretion.

A thermometer is a gauge of temperature. You can't let those trying to disguise human impact on climate change make the thermometers giving them discretion.

A price index is a gauge of prices. Likewise, we need to remove as much discretion from the @BLS_gov gauge as possible.

"This assertion X that should be main story and which is a major point of contention is stated in this part of the headline as something that cannot be argued with or changed. This part attempts to tell you how to personally cope with what has been taken away from you in part 1."

"The money supply is expanding due to choices by humans you didn't elect and who cannot be questioned. Here's how to stretch your dwindling dollar at the supermarket as your wealth is transfered through seignorage to the wealthy who hold risk assets in the capital markets."

"Because you can be portrayed as too stupid to do STEM, we're going to use that to import an entire STEM labor force from our chief strategic rival only to destroy your ability to bargain at the negotiating table. Here are 25 handy Mandarin phrases to train our new co-workers!"

"The workplace is being changed to make merit, ability, training and other attributes less important than identity. Here's how to avoid saying (and thinking) important true things in this new crazy office environment that could get you fired if you are not highly intersectional."

"We're capriciously taking away social media accounts of dissenters as a means of advancing our own interests. Here are five tips to avoid posting something smart and real, but that we can portray as misinformation to shut you down even though what you said is obviously correct."

You get the idea because you have seen it before. Please dm me your examples of this headline formula? I am thinking of starting a collection. Thanks.

Things I don't believe we can't conclusively resolve:

A) COVID's origin.

B) The Jeffrey Epstein story.

C) UAP.

D) JFK assassination.

E) Vegas Shooting.

F) Extent of 'Democracy Fortifying' in 2020.

G) Efficacy of Non-Vaccines.

H) Mysterious WEF 'Build Back Better' mantra.

Q) Joe Biden's state of cognitive decline.

R) Nature of MSNBC campagin against Andrew Yang.

S) Nature of Dean Scream, Anti-Ron Paul and other interference in democracy by Mainstream media News.

T) Impact of loss of mandatory retirement on young people seeking work.

U) Rex84.

V) Collusion between National Academy and National Science foundation division of Policy Research and Analysis to fake demographic crisis in mid 1980s.

W) Lack on anyone building the significant & desperately needed new non-profit institutions despite skyhigh wealth inequality.

X) Loss of Academic Freedom across the board in Academe.

Y) Loss of the Lancet and other publications as trusted non-political sources of fact.

Z) The true nature of @EcoHealthNYC w its relationship to @doddtra & Dr A. Fauci.

Moral: much of this 'ambiguity' is serving the few.

Can just *one* of them compute a simple Cost-Of-Living CPI for a consumer whose notion of well-being evolves even *slightly* during any period in question?

I claim not. Let's not get carried away with this concept of economic experts. This field first needs to become healthy.

An important, under-appreciated feature of the Build Back Better package is how it helps fight inflation.

It’s not just us saying so - leading economists and analysts have pointed this out. https://fortune.com/2021/09/21/nobel-prize-winning-economists-back-joe-biden-build-back-better-plan/

ANNOUNCEMENT: I head next week to @UChicago for 5 days (Nov. 8-12) at the request of its storied Department of Economics to present our theory that all of economics is based on the wrong version of the differential calculus.

Weird question. You seem to have me confused for the BLS. I don't take in Data. I don't have a staff or a budget. You're assuming that I have the 'Real Inflation & CPI numbers'. I don't.

This is about not even having a correct *theory* to calculate. What we corrected was theory.

So if you have the correct theory then why wouldn't you be able to calculate the correct results from the existing input data available?

I didn’t say what you said. I said there was a wrong theory for CPI. We corrected that theory.

The issue of how to implement a theory in practice leases to different data being collected and different aggregations. For a different theory, you would collect different data.

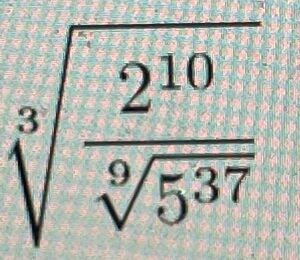

As an example. The Boskin commission gave a single illustrative example in their report using two goods, chicken and beef. They gave prices but not ordinal utility. Here is the COL answer assuming Cobb-Douglas and Linear interpolation of all quantities. They could not compute it.

The reason they had no theory to cover it was because the C-D exponent changed. And there is a claim that no extension of the Konus COL exists for dynamic tastes.

Hope that helps with your confusion. Be well.

*leads not leases in the above.

Yea I understand that and find your points interesting. So I would like to understand how we would go about invalidating the traditional theories by collecting and analyzing the correct data. I don't think those tweets answer that. I get your hypothesis.

Well I think the BLS should begin by questioning their own premises. They say they work in a COL framework. They do not. They do not share how they construct the representative consumer. How they estimate substitution if they don’t have preference data. It’s fake and a mess.

If they are going to do COLas they should estimate preferences. If they aren’t they should do mechanical index theory.

But I would use a bunch of that money to develop a research program on preference collection/imputation for substitution bias if I was running a COL shop.

Ok how many researchers would you need? Is the average salary $300k? What are the non-labour costs needed? Could this be done in 1 year?

Could we get this done with let's say $10m? Is $609m necessary for a MVP?

I am not sure. But the first question I have is do we believe ordinal preference maps are constructable from revealed preference.

Well if we were to get you started with all the resources necessary, wouldn’t the assumption be yes to apply your theory?

I would take a look at Paul Samuelson’s Nobel lecture. He goes into depth on revealed preference and preference field non-integrability. I think we have lost track of the fact that integrability of tastes was never actually settled except by fiat. Will talk on this.

Sorry to say that I've been informed that my upcoming Nov. 10, Money & Banking Workshop at @UChi_Economics will closed to non-@UChicago folks, as will the Zoom connection. Researchers in other fields/students are allowed to attend.

This sort of breaks my no closed chambers rule.

Because this is arguably the most famous econ seminar running, it's widely known for being absolutely *brutal* yet also fair (it was founded by M. Friedman). Thus I have decided NOT to get hung up on this issue, but will comit to give an OPEN seminar on the same subject if asked.

I am particularly irritated by the dismissive nature of the academic economists towards my tagging members of the Bitcoin community as if they are some kind of a joke.

If you bitcoiners want to have a jam session on this material, I'm yours. Despite our frictions, we're aligned.

I also want to say this, there is a tremendous amount of nasty Glee on #EconTwitter that this is going to be a blow out. A mauling. That I have no idea what I am in for. Etc.

If you're an economist interested in expressing your bitchery as a bet, I'm not above taking your money.

If you're an economist convinced that this is hilarious, propose a bet. Your arrogance is really my opportunity set after all...

As long as your seminar is fair, I'll be just fine. Academic econ. is in a *lot* more trouble than I am. So, if I could open the livestream, I would.

The two most dangerous printing presses in Washington DC are directed by the Federal Reserve to dilute our dollar assets, and the @BLS_gov to print CPI inflation numbers that increase taxes through underindexed brackets & slash entitlements we pay into over our working lives.

Great news, given that *every* tick of your BLS CPI forces billions of dollars to change hands.

"The concept of the cost-of-living index guides the CPI measurement objective and is the standard by which any bias in the CPI is defined."

I found this on @BLS_gov site. Is it true?

I assure you we are not dangerous! If you want to read about how the BLS calculates the consumer price index you can check out the CPI handbook of methods (https://bls.gov/opub/hom/cpi/).

I cannot find any place where the preference maps needed to construct a Laspeyres Konus COL index are gleaned through revealed preference. I will go so far as to say that this is bait & switch. There is a CLAIM of a COL framework, but no one is constructing anything of the kind.

Q1: Where exactly do I find the ordinal indifference maps constructed by BLS for a 'Representative Consumer' used to find substitution bias in fixed basket Mechanical approximations to a welfare Cost-Of-Living framework based on a Konus economic index of intertemporal welfare?

Q2: What happens to our BLS COL framework when ordinal tastes change? How is the effect of substitution due to price change disaggregated by BLS from changes in ordinal preferences? This is important because marketing, education, etc change tastes & there is no theory for this.

Let me give you the non-answers so you can correct:

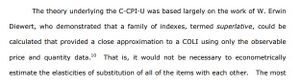

A1: "Well, you are looking at it too literally...we have studied superlative index numbers which give a second order approximation to flexible functional form...blah blah blah."

A2: "That's really an obscure academic issue."

What I'm looking for is for BLS to stop pretending it's discerning "THE rate of inflation" to admit that it's making *policy* choices while appearing to be technical. It's determining our taxes and our entitlements by indexing, with our future in its hands as mere 'technicians'.

What I'm looking for is for BLS to stop pretending it's discerning "THE rate of inflation" to admit that it's making *policy* choices while appearing to be technical. It's determining our taxes and our entitlements by indexing, with our future in its hands as mere 'technicians'.

"[A] market basket of goods and services equivalent to one they could purchase in an earlier period."

Exactly. Looking for the *exact* *technical* definition of 'equivalent' in the above. Can you point me to it? I assume it's a notion of revealed indifference in ordinal welfare.

I wasn't able to find the answer to the above. Perhaps you had better luck?

This is why it is useful to read the handbook of methods!

Since CPI is a Laspeyres-based index, the "equivalent" in this case refers to the weighting of the basket. I like this research note on the difference between the modified Laspeyres formula CPI currently uses and a possible geometric mean formula.

Uh…The Laspeyres is a *mechanical* index. The BLS site says it works within a *COL* framework.

When Mechanical = COL, it is called an exact index. You are not saying that BLS believes

Laspeyres CPI = Konus COL

I assume, because that is false. So what are you and BLS saying?

Sorry but that doesn’t make sense. It’s selfcontradictory doublespeak.

It literally just said that despite BLS COL framework claims, a Mechanical index is used w/ base periods *quantities* held fixed.

COL *requires preferences*. Where are they? There are/aren’t preference maps?

Great news, given that *every* tick of your BLS CPI forces billions of dollars to change hands.

"The concept of the cost-of-living index guides the CPI measurement objective and is the standard by which any bias in the CPI is defined."

I found this on @BLS_gov site. Is it true?

I assure you we are not dangerous! If you want to read about how the BLS calculates the consumer price index you can check out the CPI handbook of methods (https://bls.gov/opub/hom/cpi/).

I can only answer your questions in a personal capacity, not as an official representative of BLS. I would encourage you to reach out to CPI team with any questions and they would be happy to answer.(https://data.bls.gov/forms/cpi.htm?/cpi/home.htm)

The Bureau is rather open that the main Consumer Price Index (CPI-U) is only one measurement of cost of living and the prices faced by consumers', and there are good reasons that the Federal Reserve targets the Personal Consumption Expenditures Price Index instead of CPI.

In addition, the Bureau is open about the limitations of the CPI and works continually to update methods and calculations in order to improve price measurements and indexing.

The Bureau has introduced alternative data series (including the chained CPI index) to better account for the taste changes and substitution effects that reflect real consumer spending habits. You see information for that index here: https://www.bls.gov/cpi/additional-resources/chained-cpi-questions-and-answers.htm

The CPI is guided by the concept of a COL index, but is not a perfect measurement of either cost of living or inflation. The Bureau is open about the inherent flaws in the index and has had to make tough choices in a tradeoff between precision, complexity, and timeliness.

“Guided by the concept of a COL index but is not a perfect measurement.”

Can you show me *any* imperfect COL preferences to give me a sense of how far we may be off? Specifically preference maps: there is no COL without preference maps with which to evaluate substitution bias.

Q: Where do I find the imperfect preferences maps for the COL claim?

Q: How were those preference maps computed or imputed?

Q: How does chained CPI calculate taste change given the claim of the fed that time varying ordinal preferences cannot be tracked in COL even in theory?

There are no preference maps, chained CPI employs a superlative Tornqvist formula to account for substitution. The documents introducing the chained CPI do a better job outlining the methodological and theoretical structures than I could.(https://bls.gov/cpi/additional-resources/chained-cpi-introduction.pdf)

Wait. Slow down.

Did you just say that BLS is claiming to work within a Cost of Living framework which *requires* preference maps *definitionally*, but…words fail me…has no preference maps? At all??

I must not be understanding. Chaining Tornqvist indexes isn’t an answer here. https://t.co/IyIArW40OV

You mean field. Economics is actually all about fields: field operators & field theory.

Technically, inflation is classically like a Wilson Loop observable on path spaces. But economists have historically denigrated path-dependent approaches (e.g. 'cycling problems', 'drift').🤷

You have no idea how crazy econ got to make us all the same so that what we're saying can be ignored. Seriously, think about asserting that all folks have the same tastes & that they can never change so that economists can use 'Stable preferences...relentlessly & unflinchingly'.

You will see in the inflation literature various bizarre tendencies to introduce 'homogenous' or 'homothetic' utility functions and to hold these functions fixed. Ultimately it fell to 2 giants to claim that taste is universal. That way, rich/poor, you/me all have common utility.

“The combined assumptions of maximizing behavior, market equilibrium, and stable preferences, used relentlessly and unflinchingly, form the heart of the economic approach...” -Gary Becker

Followed by inexplicable & inscrutable 'work' of Becker & Stigler: https://sciencedirect.com/science/article/abs/pii/016726818990067X

The move to look out for is 'Superlative price index numbers give an excellent approximation to the true 'Cost-Of-Living'!" which totally sidesteps the field issue you bring up, the dynamic taste issue (replaced by 'Stable preferences'), & inequality (replaced by homotheticity).

All of these simplifications are made better in a fully path dependent field theory framework with endogenously determined differential operators.

Claiming we all have the same unchanging tastes (e.g. Becker-Stigler) and working in simplified regimes isn't at all understandable.

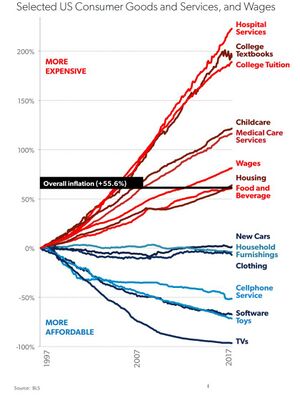

It's like publishing a number for the temperature in the US in 2020. Your path dependent price index measure of inflation is as individual as your commute. It's *mildly* meaningul to posit a 'representative commute to work' that doesn't depend on our various routes. But not very.

And we are not even trying to measure that. To this day, I can't *really* understand what CPI-U is. That is either because I'm too dumb, or the field has gone mad agreeing with itself while disconnected from reality. And I believe no one is that dumb. Even on a really bad day...

Surprise.

[Word to the wise: watch very very carefully how your CPI is constructed. You have the right to know EXACTLY how it is constructed.]

NEW: Powell says it's time to retire the word "transitory" regarding inflation https://www.bloomberg.com/news/live-blog/2021-11-29/powell-and-yellen-in-the-senate-kwkw102n

It’s hard to imagine how confused Economics is. Imagine you work for the @BLS_gov and you have to admit that your agency claims to compute our Inflation within a Cost-Of-Living framework, but doesn’t maintain the central ingredient needed to compute or even impute Cost-Of-Living.

There are no preference maps, chained CPI employs a superlative Tornqvist formula to account for substitution. The documents introducing the chained CPI do a better job outlining the methodological and theoretical structures than I could.(https://bls.gov/cpi/additional-resources/chained-cpi-introduction.pdf)

Follow the thread back from here. This is where the conversation ends. #EconTwitter may tell you terrible things about me.

Maybe. Or maybe they don’t have a theory that works and they refuse to admit it while transferring billions through CPI releases.

Wait. Slow down.

Did you just say that BLS is claiming to work within a Cost of Living framework which *requires* preference maps *definitionally*, but…words fail me…has no preference maps? At all??

I must not be understanding. Chaining Tornqvist indexes isn’t an answer here.

You cannot keep mumbling Economic word salad forever “Modified Laspeyres…core inflation…Lowe generalization of the Laspeyres…Chained Tornqvist with revisions…chain drift…superlative index approximates flexible functional form…”

Tastes change. Cost-Of-Living inflation is about tastes. If tastes evolve in time, the economists’ COL framework disintegrates. That is: there is NO theory. #EconTwitter can tell you I don’t get it.

It is THEY who don’t get it. They can’t escape it. It’s in their own literature.

What you are seeing reported as Inflation is not coming from a well grounded theory. It is coming from human beings making policy level judgements as if they were merely making technical adjustments to a technical time series devoid of values about who should benefit or suffer.

Moral: you have a right to know what’s in your food and how your pharmaceuticals were tested. You have a right to ask your surgeon what she plans to do during an operation.

You have a right to demand what economists are actually measuring as Cost-Of-Living W/O abuse for asking.

And, no, the answers to these questions are NOT in the BLS handbook on CPI methodology. I’ve looked.

The funniest part of our inflation measure is the “.8” here.

I so wish they were a little bolder and went with “6.8139942%, plus or minus 3*10**(-7) according to a Lowe index modified by hedonic adjustment for sub-aggregates” or some such.

More of us could share such a moment.

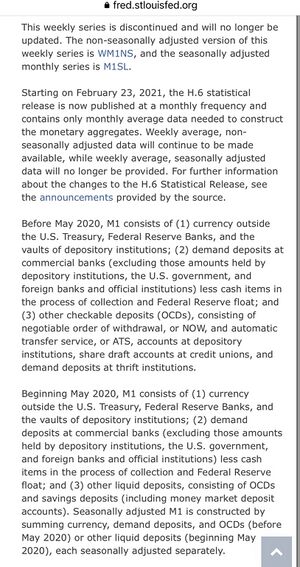

5 / The 6.8% inflation rate in the US is the highest inflation we've seen since 1982 and is understating true price increases as it assumes "shelter" (largest component of CPI @ 33%) only increased 3.8% in the last year.

Breakdown of reported CPI:

The meaning of the .8 is significant, but only because of the wealth that will be transferred by it. It is not really meaningful as part of a measure of the cost of living for the representative consumer.

It’s effectively made up to make the “6.x” look solid. Which it isn’t.

Do you actually have a point here? Your quibble is with the “.8” because it “makes the 6.x look good”??? How do you figure. I honestly think you tweet sometimes purely for the sake of it

Eric, I am one such enlightened follower..

In what regard/magnitude is stochastic path dependency to change such CPI value if prior estimates are proportionately miscalculated? At this point in time, how best would you gauge the relative rate?

This seems to be more along the line of your “nuclear vs nucular” reference by which we quibble about semantics, with absurdly low impact on the end problem. The lack of precision for x path dependent function would similarly yield y persons debating lack of precision..

D) Embrace curvature if moving to chaining.

E) Publish methodology of basket or representative consumer(s). BLS isn’t an oracle.

F) Consider moving to a Cobb-Douglas/CES aware changing preference mechanical index if wedded to COL.

G) Admit to conflicts of interest (Boskin).

H) Move to field theoretic & group-valued indices (e.g. GL(2, R) indices for trade).

I) Stop trying to hide Holonomy. It’s there. Accept that it is supposed to be there rather than hiding it with Walsh multi-period circularity test.

Etc.

But please stop making vacuous claims.

I’m prepared to have high level conversations about this. But our current system is an abomination. No one knows what is in or out. It’s a black box that means little. The theory is bad. The explanations are fake. And the system is opaque. Even a Laspeyres without lies is better.

2022[edit]

We should talk about national security and the Money Supply even before we talk about national security and crypto.

We should talk about CPI inflation #s and index number methodology at @BLS_gov before we talk about crypto threats.

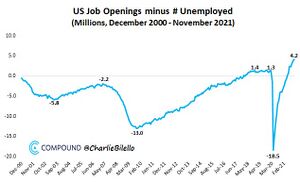

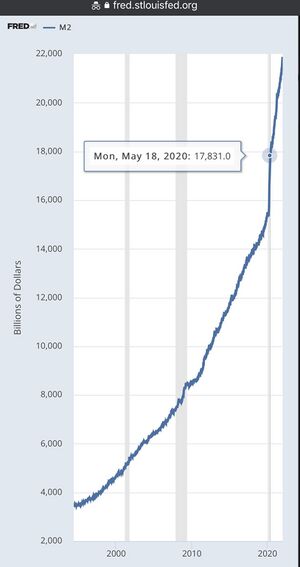

M2 monetary aggregate from the St Louis Fed:

You are experiencing 7.5% inflation.

You are getting sleepy. So very sleepy.

You no longer need to know how hedonic adjustments are calculated.

You don’t need to worry about C-CPI-U, tax brackets, Social Security adjustments.

#EconTwitter’s got this. Your lids feel heavy now.

Relax. Think of a summer’s day with a light breeze.

Why worry about May 2020 after all? It simply causes stress to read so many words.

There was a data series discontinuity. It is probably all an artifact. A data flaw. Mother will take care to make sure baby is safe and warm.

Don’t worry about the 7%. Just remember the .5%. That precision tells you @BLS_gov knows what it is doing.

Focus on the .5% and remember: it’s only your taxes, wages, life savings and benefits on the line.

It’s not your health. You can read a book. Money, isn’t everything…

Let the experts handle this. People study this for years. Don’t listen to non experts. Experts have this. Expert expertise is so very expert that you the non-expert may come to fear expertise if you listen to non-experts.

I’m sure if there is a problem they will warn you. #2008

7.5%. You are all experiencing 7.5%

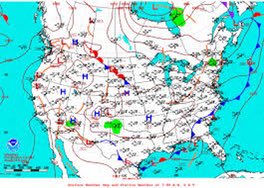

Imagine @NOAA were like @BLS_gov and released a single number called CTI: Consumer Temperature Index. It was a measurement of the “Temperature Change In America” computed in some random US city that they picked & changed at their discretion to represent that faced by Americans.

You’d DEMAND a field map so that they didn’t quote a temperature in Miami when you lived in Nome Alaska.

Ok.

So @BLS_gov quotes you 7.5% inflation and NONE of you know what it represents, and NO economist on #EconTwitter will explain the .5% precision?

Demand CPI be a field.

“Immigration has no negative effects.”

“I won’t make you pregnant.”

“Two weeks to flatten the curve.”

“NAFTA is a rising tide lifting all ships.”

“US STEM employers are facing a deep labor shortage.”

“Inflation is transient.”

“CPI is a measure of the COL.”

“Iraq has WMD.”

genuinely curious:

the fed has smart people. how were they so wrong about inflation being transient, when it seemed so obvious to most people that it wasn't going to be?

Presidents, Senators, Representatives, Agency Heads, Operatives, etc. in a democracy, must and can be *forced* into accountability. This is what Ronald Reagan sounded like when forced out of prolonged silence over the Iran-Contra scandal:

You can *force* your representatives to hold deep painful searching hearings. What is our problem with forcing open hearings on Epstein, Wuhan/Covid-19, Afghanistan, CPI?

This is what meteorologists condition you to think of as “reporting the weather”:

Contour lines. .

Dynamic fronts.

Probability distributions for rain.

Vector fields for wind.

Scalar fields of pressure & temperature

By contrast, Economists tell us your CPI is 8.3%. Discuss.

[Yes there are sub reports on inflation. But the use of, and focus upon, a single number with opaque methodology and misleading description is preposterous. Bad theory. Bad economics. Bad government.]

A cost of living index is something like a group valued field on path spaces of seasonal loops of dynamic preferences and prices. It’s not a damn number. It’s just not. This is theater.

You seem to be the 1st to ask. Been waiting years for this question. Thank you!

Take 3 stylized goods:

F = Food in kgs

G = Gasoline in ltrs

H = Housing as Rent in sq meters

Assume Cobb-Douglas tastes with 2 exponents a_F, b_G (so c_H=1-a_F-b_G) & prices p_0, p_1in R^3 x R^3.

@EricRWeinstein so how do we make a gauge theory economic chart similar to your meteorological analogy?

The COST OF LIVING that @BLS_gov pretends to calculate, for any price vectors as above is now a function on the 2-simplex (a_F,b_g) called the Laspeyres Konus formula.

Only one computer programmer needs to be able to understand the above. She can build the function in python.

That function is akin to the temperature or pressure I keep talking about in the standard inflation theory. From there, we move to what is wrong with the standard theory. But this would already show you what is wrong with BLS’ crazy claims to be computing the cost of living. 🙏

That is not gauge theoretic yet because we are assuming fixed tastes. But we have to understand the **mountain** of layered nonsensical assumptions in CPI measurements of COL inflation. CPI as COL isn’t even consistent with pre-gauge theoretic theory. It’s sort of unbelievable.

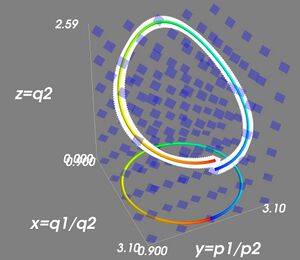

Great question. Inflation is SUPPOSED to be a group valued field. In the case of bilateral trade it’s an element of GL(2,R) although the economists haven’t gotten there yet. But it is mostly not a field on Geography. It’s a field on path, Loop, preference and geographic spaces.

I have heard you say inflation looks more like a heat map, than a single number. Would you say a heat map by both geography and product? Good morning

Q1: Why is it a field on Preferences?

A1: Because a true COLA is not an index on baskets (mechanical index) but on welfare derived from baskets (economic index). BLS misrepresents CPI being COLA-driven abusing work of Erwin Diewert on Superlative indices. A COLA prices WELFARE.

Q2: Why is inflation a field on LOOP spaces of preferences?

A2: Tastes are seasonal. In USA “We never spill Egg Nog on our bikinis.” What you both want & price HAS to be made seasonal to avoid the Cycling Problem (Holonomy) in index number thy. So we have LOOPS of tastes/prices.

A2 Continued: If you don’t make loops of tastes and prices, you will show meaningless regular inflation if prices, quantities and tastes Circle back to their initial Jan 1 values. This confuses economic experts (Like Diewert) when it comes to chain/path indices…which is up next.

Q3: Why is inflation a field on Path Spaces of Looped Preferences/Prices?

A3: Loosely, Index number theory really died w/ work of Ragnar Frisch (rightly) destroying Irving Fischer’s misguided work on axiomatic tests for bilateral (2 period) mechanical index numbers. Here’s why.

A3 Cont.: As Ken Arrow challenged us “Frisch showed we can’t solve the bilateral index problem because a single agent at multiple points in time is *exactly* dual to multiple agents at a single instant of time. Which is exactly my ‘Impossibility Theorem’ in Social Choice. QED.”

A3 Cont.: Our response: “Ah. That would be true but for 2 differences! First, Indices live in markets with *prices*. Our methods *don’t* live in social choice voting paradigms. Second, agents evolve into their future selves via paths. There’s no ‘morphing path’ in social choice.”

A3 Cont.: “This is why index numbers will one day be properly understood as parallel translation in Fiber Bundles wrt Economic Gauge Potentials. But Zoe doesn’t become Cam morphing into Fatima when voting. So parallel transport is unavailable. Even in topological social choice.”

A4 Cont.: Only 1x1 matrices commute. NxN matrices do not! And if A.B isn’t B.A, the system goes non-linear. So if you have 2 countries with 2 currencies, the commutative case doesn’t work at all. You need to use Freeman Dyson’s system of Time Ordered Products to save inflation.

A4 Cont.: But even in the case of one Currency like the Dollar, economists don’t get the group issue. True COLAs are valued in an *infinite* dimensional non-commutative group called DIFF_0(R^+) equivalent to increasing differentiable functions from 0–>♾ reparameterizing ‘Utils’.

Q5: So let’s see. Inflation is a field like temperature. But a field in a fiber bundle over ♾-dimensional path spaces of loops of preferences/prices valued in non-commuting groups leading to non linearities not addressed by economists? What about actual geography!”

A5: Fair. 👍

A5 Continued: Prices vary by zip code. So throw in a geographical map as a reward for getting to the end!

Just try to understand my bewilderment when @BLS_gov says 7.9% and everyone pretends that they aren’t really raising taxes & slashing social security. You’re being screwed.

Your life savings are being stolen through seignorage as you are being taxed into oblivion with your social Security beaten to a pulp. Meanwhile @paulkrugman and Robert Reich are playing with finger paints.

If you want help, do let me know. But I can’t watch this massacre again.

Either do something to save yourselves or continue to sit & wait to be eaten by the Fed and @BLS_gov’s fakely precise single number CPI.

I’ll debate ANYONE on this high enough up for you. But I can’t watch & I’m done w economist abuse & yelling at clouds.

Thanks for asking.🙏

Note Added After Posting:

I responded to a question about proper index construction here. Would love to have Prof @RBReich thoughts. Maybe even a debate on CPI and measurement?

Great question. Inflation is SUPPOSED to be a group valued field. In the case of bilateral trade it’s an element of GL(2,R) although the economists haven’t gotten there yet. But it is mostly not a field on Geography. It’s a field on path, Loop, preference and geographic spaces.

{{Tweet

|image=Eric profile picture.jpg

|nameurl=https://x.com/EricRWeinstein/status/1589298124191043584

|name=Eric Weinstein

|usernameurl=https://x.com/EricRWeinstein

|username=EricRWeinstein

|content=They have two black boxes. One is called CPI construction. One is called the Fed. The theory is a narrative. The narrative doesn’t match the actions.

|thread=

{{Tweet

|image=Eric profile picture.jpg

|nameurl=https://x.com/EricRWeinstein/status/1589287901804007425

|name=Eric Weinstein

|usernameurl=https://x.com/EricRWeinstein

|username=EricRWeinstein

|content=Great question. Inflation is SUPPOSED to be a group valued field. In the case of bilateral trade it’s an element of GL(2,R) although the economists haven’t gotten there yet. But it is mostly not a field on Geography. It’s a field on path, Loop, preference and geographic spaces.

|quote=

{{Tweet

|image=invisi_college1-profile-s_fl5CzZ.jpg

|nameurl=https://x.com/invisi_college1/status/1589261786934493184

|name=invisible_college

|usernameurl=https://x.com/invisi_college1

|username=invisi_college1

|content=I have heard you say [[Inflation|inflation] looks more like a heat map, than a single number. Would you say a heat map by both geography and product? Good morning

|timestamp=2:21 PM · Nov 6, 2022

}}

|timestamp=4:05 PM · Nov 6, 2022

}}

And preference space is unknowable without just letting a free computation run. Anything else involves some humans telling other humans what their preferences must be.

Sure! And as Samuelson said, it may not even be integrable. And it may be that you are mixing stocks and flows. Etc. But then don’t say you are implementing Konus COLAs while pretending that mumbling “ superlative Index number are exact for flexible functional forms” makes sense.

The main issue here is simply super invidious priestly bull shit used to cover the destruction of people’s lives. Thanks!

Wow, I'm going to have to Google half of that. I feel too dumb for this conversation. Am I reading correctly that the above tweet is sarcasm, and you're saying there's a deeper intellectual problem here?

|timestamp=4:46 PM · Nov 6, 2022 }}